Every Web3 Bull Market Has a New Narrative. The Dynamic Never Changes.

My Web3 Journey: From Hopeful to Jaded to… Meh

My Macbook breaking is what got me to my first Web3 event in years.

I’d registered for “Agents Unleashed: The Next Wave” earlier in the week - curious, but maybe not curious enough to actually make the trip down. It was a Token2049 side event about AI agents onchain. I thought “maybe I’ll go, maybe I won’t.”

Then I needed to get my laptop fixed.

Apple store: Marina Bay Sands. Event venue: ArtScience Museum, right next door. Status: Already registered. Food: Free.

Decision made.

So there I was yesterday, surrounded by starry-eyed crypto enthusiasts and Web3 builders, all rocking their Token2049 lanyards and tote bags. The air buzzed with familiar jargon I hadn’t heard in years: onchain, tokenomics, RWAs.

And me? I was just there because my laptop broke and I was already in the area.

Here’s what struck me: things have changed somewhat, but largely remain the same.

The Core Pattern Never Changes

Everything still revolves around tokens. Every conversation, every pitch, every “revolution” ultimately circles back to: how do we create, distribute, and trade tokens?

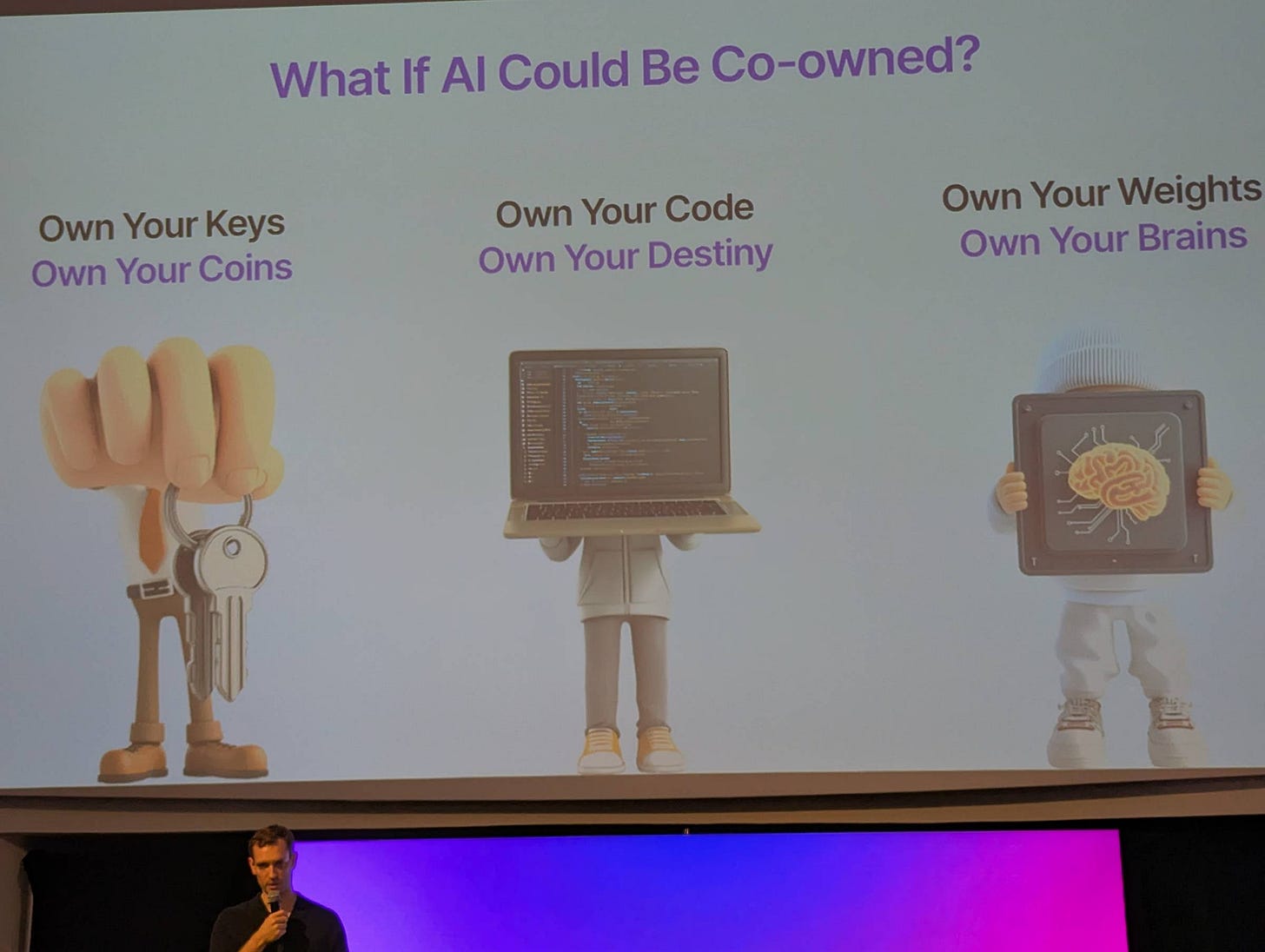

There’s always talk about ownership and rising up against the “platform landlords.” The narrative positions us regular folks as digital serfs toiling for Big Tech overlords - Google, Meta, Apple extracting value from our data and creations while we get scraps.

And look, I get it. Platform capitalism IS extractive. But I’m not sure if Web3 is actually solving this problem…

How My Stance Has Evolved

My relationship with Web3 has gone through phases: hopeful → believer → jaded → meh, let’s see what happens.

Here’s the timeline:

2017: The Gambler Phase

I started buying crypto in 2017. I didn’t really know what I was doing. I was literally gambling.

I made some money. I lost some money.

It was stock picking without due diligence. Thankfully, I stuck mostly to the “blue chips” - Ethereum and Bitcoin. I didn’t get rich, but I learned a crucial lesson: investing in things you don’t understand = gambling and hoping for the best.

2021: The Believer Phase

I joined Antler’s SG9 cohort in 2021 when Web3 was booming.

The hype was REAL.

Everyone was talking about it. Some peers were pivoting their entire companies into Web3, others were building on it, most were just… gambling (as I like to call it) but with better vocabulary.

This is when I actually understood what was happening: blockchains are just software platforms where other platforms can live on.

My team’s idea evolved too. We started off wanting to create more transparency in the art industry. By the end of Antler, we had pivoted into wanting to create NFTs and then a prediction market platform, riding the Web3 wave.

(In hindsight, what we were trying to do is now a piece of cake with GenAI. But that’s a different story.)

So I dove in. I explored different protocols, different chains. I learned about DeFi, NFTs, DAOs.

More gambling ensued… this time with leverage. (I know, I know.)

2022: The Builder Phase (and The Collapse)

After Antler, I got a job as a product manager at a Web3 company in early 2022.

This is when I actually started building Web3 protocols.

I got exposed to the inner workings of many Web3 projects.

Here’s the uncomfortable truth: a lot of these protocols exist primarily to enrich their founders and early investors. Not all of them are outright scams, but the incentive structures are… problematic.

Token launches. Airdrops. “Governance” is mostly just theater.

But I was a believer. I was testing protocols, learning the tech, building products.

Then May 2022 happened: Luna/UST imploded.

The entire algorithmic stablecoin experiment collapsed in spectacular fashion. Some people made money shorting it. Most people lost everything.

I lost the money I was using for testing protocols on Terra. Not life-changing amounts, but enough to sting.

Luna’s death spiral took down legit companies too - Celsius, Three Arrows Capital, Voyager Digital. The contagion was real.

November 2022: The SBF/FTX scandal.

And just when we thought things couldn’t get worse, Sam Bankman-Fried’s empire collapsed, revealing fraud at a massive scale.

Luckily, “believer me” had most of my funds in decentralized wallets. I dodged that bullet.

But watching the industry implode twice in one year… that changes you (coupled with the fact that quite a few protocols at the time were outright scams in disguise).

2023: The Skeptic Phase

I stopped building in 2023 because something had shifted.

I was no longer a believer. I was… observing.

Humans will always be humans: we think we’re the lucky ones who’ll get in early, who’ll time it right, who won’t be left holding the bag.

The Fundamental Problem

As an industry, Web3’s main use case has always been about making money from money.

The entire DeFi ecosystem exists for this purpose.

If you look at these chains as closed ecosystems, people can only make money when someone else loses money. It’s largely zero-sum:

In bear markets: Money swirls around within the chain from protocol to protocol, using leverage to manufacture returns from thin air. Trading becomes increasingly predatory.

In bull markets: Money is made primarily because there’s an infusion of new cash from new participants. Classic greater fool dynamics.

Then there’s the Real World Assets (RWA) tokenization pitch.

The idea: bring real-world stuff onchain, assign it value, distribute ownership through smart contracts.

But here’s the thing: ownership is ultimately governed by jurisdiction laws, not smart contracts.

Sure, you can hold tokens that say you own a fraction of a building. But in a legal dispute, what happens? The court looks at actual legal ownership structures, not your blockchain wallet.

What problem does this actually solve? Does it solve housing affordability? No. Does it meaningfully increase access to investment opportunities? Marginally, maybe. Does it reduce transaction costs? Sometimes, but often not.

It’s just another way for people to financialize more things.

And Now… AI Agents?

Which brings me back to yesterday’s event.

The latest trend: AI agents onchain.

People creating autonomous agents that trade, interact, execute strategies - all living on blockchain rails.

Marketplaces for AI agents. Tokens for AI agent performance. Agents trading with other agents.

One founder was presenting use cases for onchain agents: using agents to trade, then ranking them by efficacy. The pitch was slick. The technology was interesting.

But to me, it was just more of the same.

Using agents to predict market movements through abstract mathematical calculations doesn’t make it less gambling. It’s just shifting the responsibility of due diligence from humans to algorithms and making speculation more accessible.

I don’t know what to make of it yet, but it feels like more of the same. Another layer of abstraction, another way to create tokens, another narrative for the next bull market.

The Central Irony

Here’s what gets me:

The people building in Web3 want to free themselves through decentralization and “owning their data.”

But the industry can’t seem to free itself from the fact that it exists primarily to help people make money from money.

Not to solve problems. Not to create value. But to create new financial instruments and speculation opportunities.

Every few years, there’s a new narrative:

2017: Digital gold, censorship-resistant money

2020: DeFi summer, yield farming

2021: NFTs, the metaverse

2023: Real World Assets

2025: AI agents onchain

The technology changes. The talking points evolve. But the core dynamic remains: create something people can speculate on, extract value from that speculation, repeat.

My Honest Take

So what do I actually think about Web3 now?

I’m not anti-crypto. The technology is genuinely interesting. Permissionless innovation has value. Transparent, verifiable transactions have use cases.

But I’m deeply skeptical of the promises that keep getting made:

Doesn’t work: “True ownership” - ownership still relies on legal systems, not just blockchain

Actually works: “Censorship-resistant money” - this one genuinely works, which is why governments are worried

Doesn’t work: “Disrupting Big Tech” - we’ve just created new intermediaries

Unclear: “Programmable money” - interesting concept, jury’s still out on real utility

Here’s what I believe:

Web3 will likely exist alongside Web2, not replace it. Just like Bitcoin didn’t replace the dollar, smart contracts won’t replace traditional legal agreements.

There will be niche use cases where blockchain technology makes sense - probably in supply chain, certain types of digital rights management, international remittances, and some experimental governance models.

But the revolution isn’t coming. At least not the one being promised at conferences.

The real revolution might be much quieter - boring infrastructure improvements, specific use cases where transparency genuinely matters, places where middlemen truly add no value.

Where I Am Now

Meh, let’s see what happens.

I’m not building on Web3 anymore. But I’m still watching.

I’m curious about the AI agent stuff, but I’m too busy exploring how to use it rather than bringing it onchain.

I’ve learned that every bull market creates true believers, and every bear market creates ghosts.

The technology might mature. The use cases might crystallize. The speculation might give way to utility.

Or it might just be another cycle of hype, speculation, collapse, repeat.

If there’s one thing I’ve taken away from my Web3 journey, it’s this:

Be skeptical. Do your own research. Don’t invest what you can’t afford to lose.

The only thing I’m certain about is that I’m uncertain.

And honestly? That’s probably the healthiest place to be.

P.S. The free food was decent. The conversations were… predictable. But at least I know where things stand.